The Turnberry office will close early on 24th and 31st December. We will be closing at 12h00 on these days and we will be back in office the following working day.

Increase in the OAL (Overall Annual Limit) – effective 1st April 2024

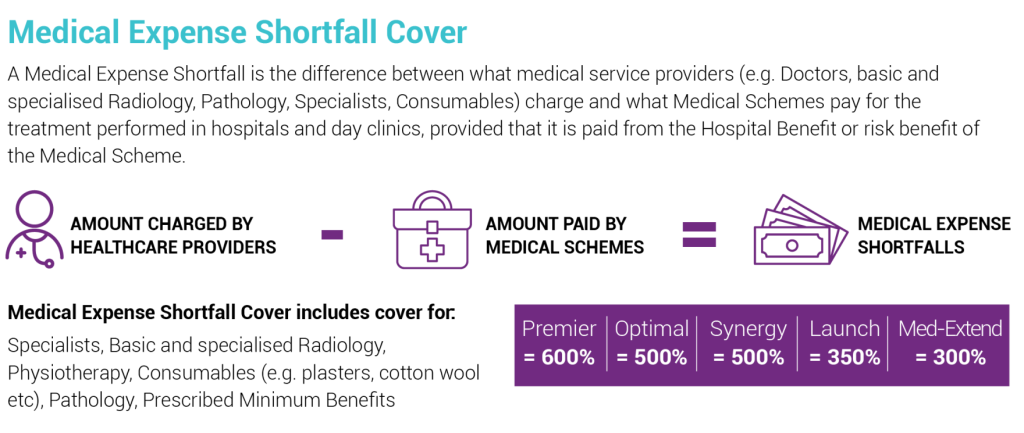

National Treasury annually publishes new limits under the Demarcation Regulations. As of 1 April 2024, the limit for medical expense shortfall (Gap) policies has been increased from R198,660.43 to R210,580.06. Turnberry has increased the overall annual limit on all policies we administer with these benefits, with effect from 1 April 2024. Our clients automatically qualify for the adjusted overall annual limit.

Gap cover is a short-term insurance product that helps protect you from medical expense shortfalls, which happen when your doctor charges more than the medical aid rate for in-hospital treatment, or the hospital charges co-payments for operations. These unanticipated expenses can leave you with an unexpected financial burden that you will have to pay for out of pocket. With rampant medical inflation and the cost of medical procedures constantly increasing, this could easily run into hundreds of thousands of Rands.

As medical aids are under constant pressure to balance benefits with affordable contributions, they have had to resort to creative strategies to attempt to maximise coverage. This means that co-payments now exist where previously there were none, and members are now being restricted to using certain providers at certain networks, with penalties applied if patients go outside of these networks.

Gap cover has become an essential component of any financial portfolio to protect you against potentially crippling medical expense shortfalls, no matter how young and healthy you are. Often, it is the unforeseen that can result in the most significant medical expense shortfalls, but with gap cover in place you can protect your financial wellbeing alongside your physical health.

Turnberry’s Mission is to offer our Clients security and assurance, especially during those times when they need us most.

Click here to Apply and Get Cover, or if you need a Turnberry representative to contact you to assist with the solution to suit your needs, please click here.

PRODUCT RANGE 2025

What is Gap Cover?

Get in touch today!

Recent Posts & Podcast Episodes

Call us!

011 677 9891

Client Testimonials

Just over a year ago, at age 64, I was diagnosed with a stage 3b lung cancer, an unexpected blow that I had never anticipated and was revealed by a covid cough that would not abate. It was a difficult and emotionally turbulent time, and in the midst of arranging chemotherapy and coming to terms with my diagnosis, many blessings have shown up in my life, and a significant blessing has been the financial support from Turnberry

Excellent, easy and quick replies with quick payments, really no hassles. Must have Gap cover, without it we would have been in financial trouble, Turnberry makes it easy. Health and medical insurance are not easy and claiming has always caused us anxiety but we can honestly say we are impressed, from sending the claims, the communication, professional and friendly staff not to mentioned the quick payments has made a difficult situation so much easier. We have been so impressed by how quickly the claims have been processed which allows us to settle the service providers quickly and we are very grateful for this excellent service. We will be promoting Turnberry to family and friends as it has been a pleasure working with you and we look forward to dealing with your company.

My interaction with the claim submission was great. I have unfortunately not needed to deal with the Turnberry claim staff members. But from my experience, I would recommend Turnberry Gap Cover. What rating would I give Turnberry – ‘from the outcome, it would be 10’.

It is always a pleasure with Turnberry. My recommendation to anyone thinking of taking out Gap cover – ‘do not live without it – it is the best add on to having medical aid, reducing your headaches and stress. Always a great partner’. I would rate Turnberry 10 Plus.