Gap Cover is short-term insurance that protects you from medical expense shortfalls not fully covered by your medical aid—such as co-payments or specialist fees exceeding scheme rates. As healthcare costs continue to rise and medical aids apply more restrictions, Gap Cover has become essential to safeguarding your financial wellbeing. It offers peace of mind, ensuring you’re covered when unexpected medical expenses arise.

Medical aid alone is no longer enough to fully protect you from the rising costs of healthcare. Doctors may charge more than medical aid rates, and hospitals can impose co-payments or fees not covered by your plan—leaving you with significant out-of-pocket expenses.

Gap Cover is a short-term insurance product designed to cover these medical expense shortfalls. As medical schemes introduce more cost-containment measures—such as co-payments and provider network restrictions—Gap Cover plays a vital role in ensuring your financial protection.

Regardless of your age or health, unforeseen medical events can happen. Having Gap Cover in place provides critical support during life’s unexpected moments, helping you safeguard your financial wellbeing while accessing the care you need.

At Turnberry, our mission is to offer clients security and assurance—especially when it matters most.

Apply and get covered or if you need a Turnberry representative to contact you to assist with the soution to suit your needs, please click here.

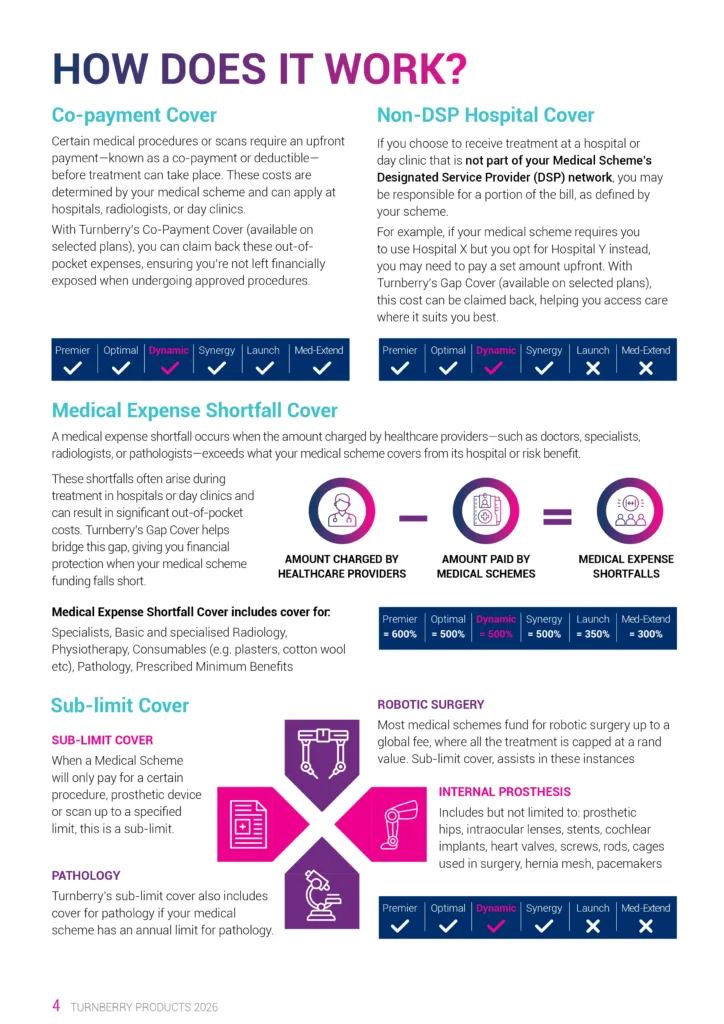

Gap cover is a short-term insurance product that helps protect you from medical expense shortfalls, which happen when your doctor charges more than the medical aid rate for in-hospital treatment, or the hospital charges copayments for operations. These unanticipated expenses can leave you with an unexpected financial burden that you will have to pay for out of pocket. With rampant medical inflation and the cost of medical procedures constantly increasing, this could easily run into hundreds of thousands of Rands.

As medical aids are under constant pressure to balance benefits with affordable contributions, they have had to resort to creative strategies to attempt to maximise coverage. This means that co-payments now exist where previously there were none, and members are now being restricted to using certain providers at certain networks, with penalties applied if patients go outside of these networks.

Gap cover should be part of your financial planning no matter your age or life stage. It is never too early to start thinking about your financial future, because the sooner you start the more time you have to plan, save and invest. Effective financial planning is essential whether you are in your 20s, your 80’s or any age in between, and this does not just mean having retirement annuities in place. With the rising cost of medical treatment and increasing shortfalls in medical aid cover, medical expenses can easily become a burden, and while you are typically young and healthy earlier in life, accidents happen and the older you get, the more likely you are to need costly medical treatment. Gap cover has become a vital part of a comprehensive financial planning toolset, no matter what your current age or life stage is.

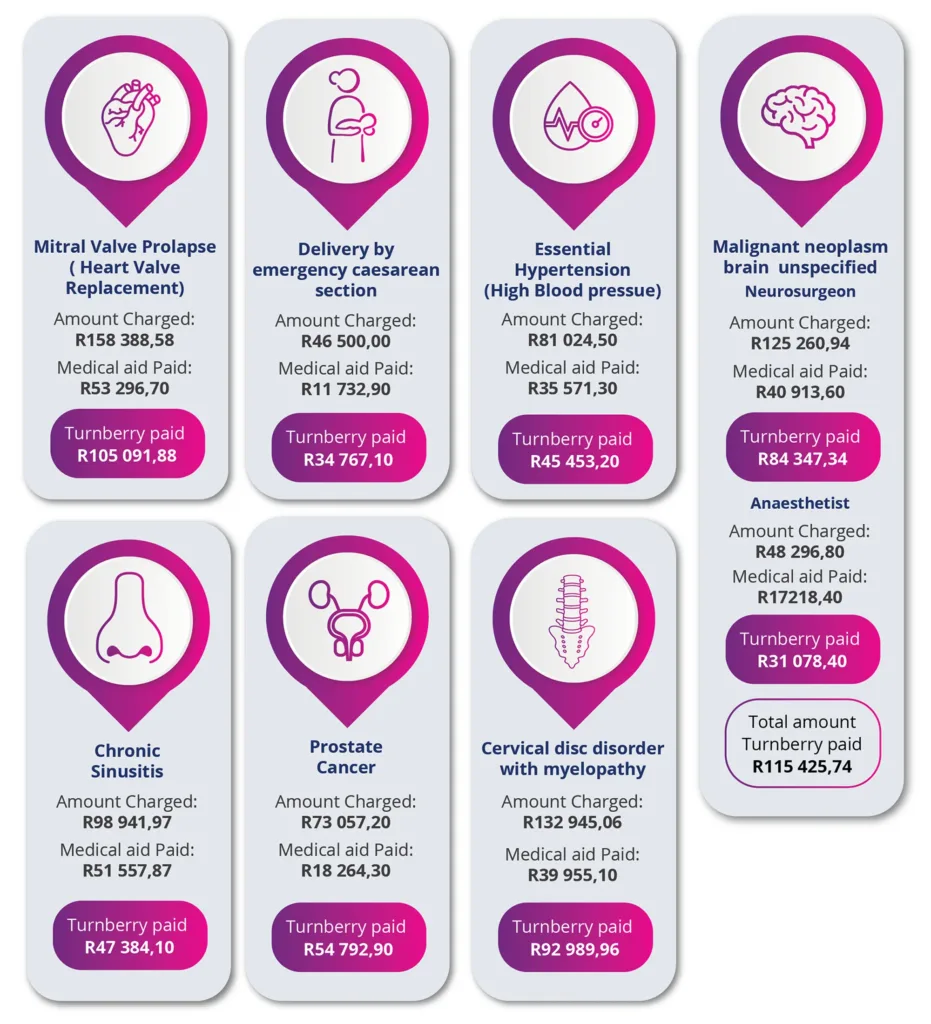

Claims paid by Turnberry over the past 12 months

Client Testimonials post claim submissions