Group Gap Cover is an investment in people that pays dividends in performance, retention, and workplace culture.

Stand out by caring more

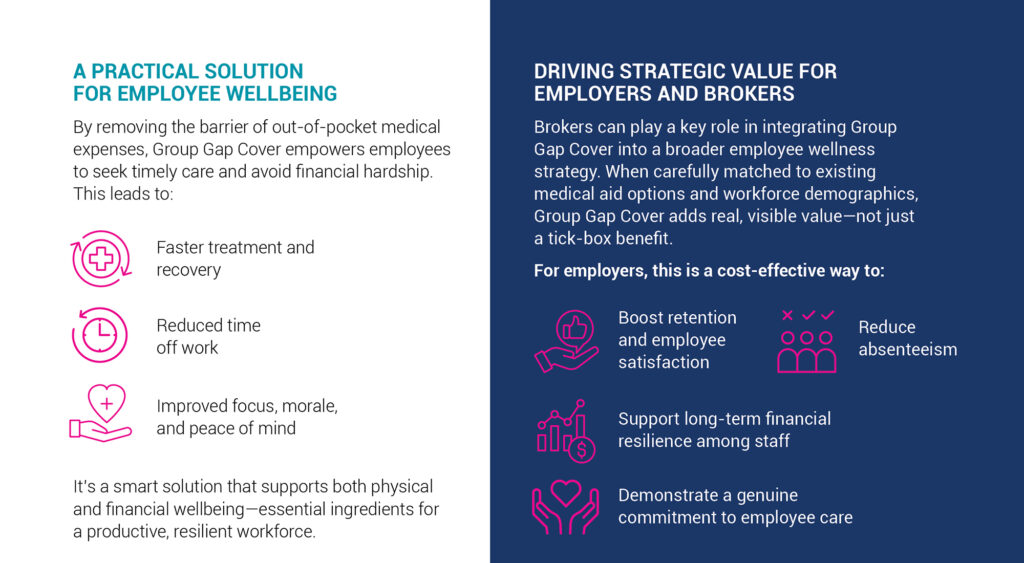

Today’s talent is looking for more than just a salary—they want to feel supported. Offering Group Gap Cover shows you’re invested in their wellbeing. It builds trust, strengthens loyalty, and creates a work environment where people feel valued and protected.

WHY EMPLOYEE BENEFITS SHOULD GO BEYOND MEDICAL AID

Rising medical costs, rising stress

Medical inflation continues to outpace salary growth, and even the best medical aids are introducing more copayments, benefit limits, and network restrictions. These changes shift the financial burden onto employees often when they’re at their most vulnerable. As a result, healthcare shortfalls can lead to stress, debt, and delayed treatment, which ultimately affect productivity and morale in the workplace.

Group Gap Cover: Closing the financial gap

Group Gap Cover helps protect employees from these growing shortfalls by covering the difference between what healthcare providers charge and what the medical scheme pays. It also covers co-payments, sub-limits, and other unexpected costs related to in-hospital treatment or specialised procedures—depending on the plan chosen.

Cost effective and easy to implement

Unlike increasing medical aid contributions—which often still leave gaps—Group Gap Cover provides broad protection at a fraction of the cost. With group rates, flexible underwriting, it’s affordable for employers and accessible to employees. Most importantly, it can be rolled out with minimal administration.