Increase in the OAL (Overall Annual Limit) – effective 1st April 2025

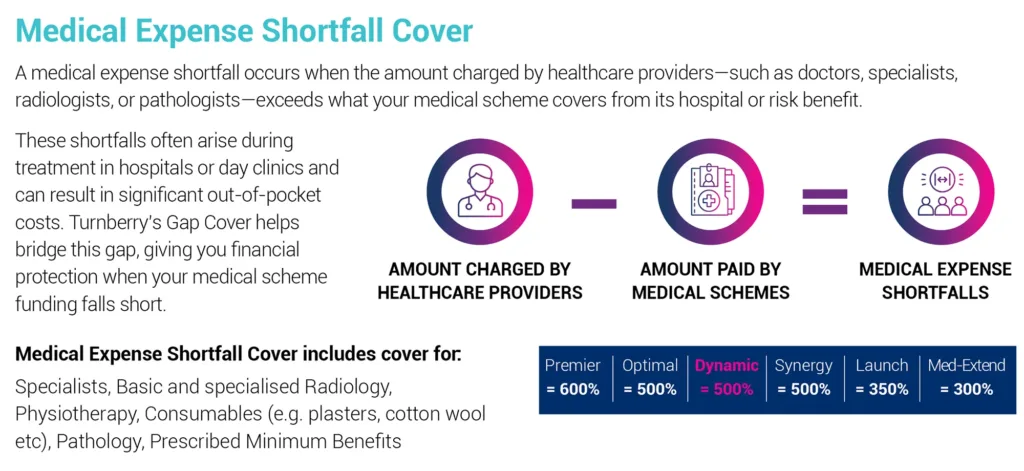

National Treasury annually publishes new limits under the Demarcation Regulations. As of 1 April 2025, the limit for medical expense shortfall (Gap) policies has been increased from R210,580.06 to R219,845.96. Turnberry has increased the overall annual limit on all policies we administer with these benefits, with effect from 1 April 2025. Our clients automatically qualify for the adjusted overall annual limit.

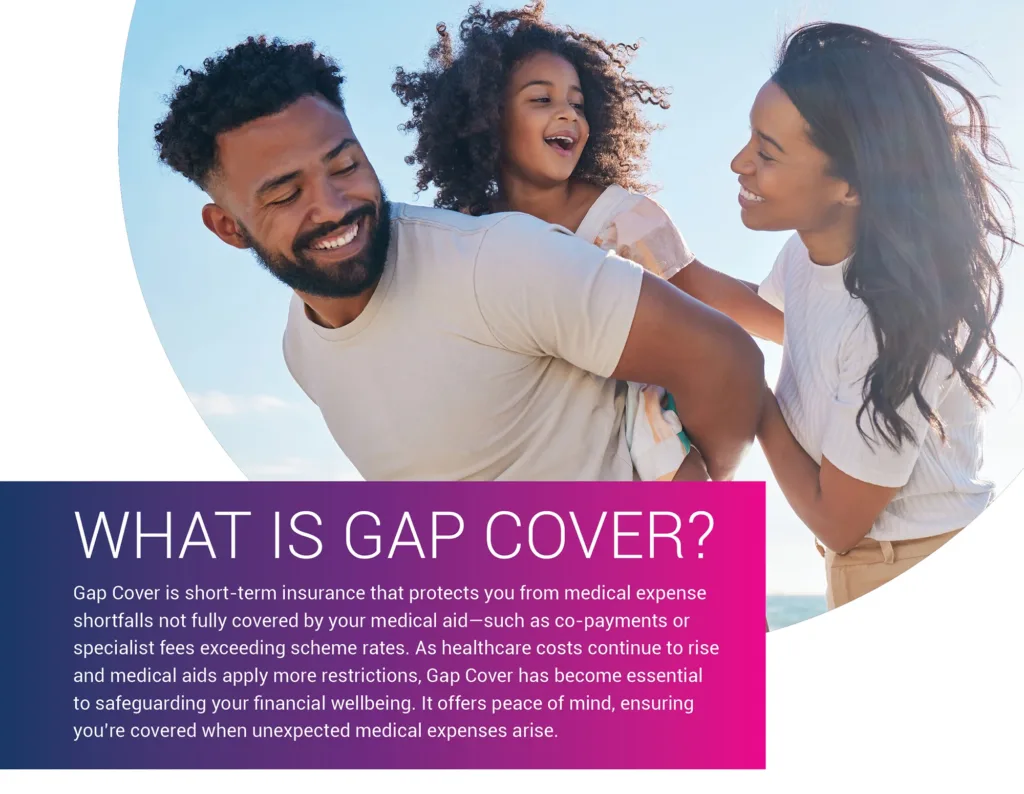

Medical aid alone is no longer enough to fully protect you from the rising costs of healthcare. Doctors may charge more than medical aid rates, and hospitals can impose co-payments or fees not covered by your plan—leaving you with significant out-of-pocket expenses.

Gap Cover is a short-term insurance product designed to cover these medical expense shortfalls. As medical schemes introduce more cost-containment measures—such as co-payments and provider network restrictions—Gap Cover plays a vital role in ensuring your financial protection.

Regardless of your age or health, unforeseen medical events can happen. Having Gap Cover in place provides critical support during life’s unexpected moments, helping you safeguard your financial wellbeing while accessing the care you need.

At Turnberry, our mission is to offer clients security and assurance—especially when it matters most.

PRODUCT RANGE 2026

What is Gap Cover?

Get in touch today!

Recent Posts & Podcast Episodes

Call us!

011 677 9891

Client Testimonials

BEST INSURANCE PRODUCT I HAVE EVER PURCHASED. Have claimed numerous times and always been paid in full in a short space of time. No drama or fuss of insurer looking for reasons not to pay. I have already recommended Turnberry Gap Cover to my family, friends and colleagues, and will continue to do so. Happy to have my name used for a product that I highly recommend.

So far I have been very satisfied with each claim that I have submitted. I have been emailing my claims directly online on the website, and attaching all the relevant documentation. Does everyone need Gap Cover? ‘Do it, you never know when you might need it, trust me you won’t want to be without it!’

We are very happy Turnberry customers. Turnberry has assisted us with claims payments for 2 spinal operations for just under R200k within a year. We have paid the Doctors and they were stunned with the quick claims payments to them. The claims Assessing team is SO Professional with a great Claims Manager. Thank you for your effective, quality and quick turn-around-time. We will continue to tell everyone about Turnberry. Thank you!