Turnberry Gap Cover policies have 2 different waiting periods.

-

The first is a general waiting period of 3 months

-

The second is condition specific waiting periods

The 3-month general waiting periods is 3 months from the commencement date of the policy, during which an insured person is not entitled to claim for any policy benefits. Turnberry does understand that accidents do happen and therefore the 3-month general waiting period will be waived in the event of an accident. An accident is defined as a bodily injury caused by violent external means.

A condition specific waiting period is a time period of up to 12 months when you cannot claim for a specific condition. For example – treatment or surgery for Hysterectomy, hysteroscopies, endometriosis, ovarian cysts, and fibroids, muscular-skeletal (except in the event of an accident, which occurred while on the Policy), tonsillectomy, myringotomy, grommets, adenoids, wisdom teeth, hernia, cataracts, gastroscopies, colonoscopies, nasal and sinus, cancer.

10 month waiting period on pregnancy / childbirth. For example, a 10-month waiting period on pregnancy/ childbirth

Why are waiting periods necessary?

Waiting periods prevent anti-selective behaviour from occurring, this is when a member only joins due to an upcoming procedure and then cancels the policy shortly thereafter. For example, Johnny needs a hip replacement due to wear and tear and knows that his orthopaedic surgeon charges above medical aid rates so he takes out a Gap Cover Policy. If the policy had no waiting periods Johnny could go that same month and have the hip replacement and submit claims to Turnberry and cancel the following month. In this instance the member would benefit from Turnberry paying thousands of rands in claims in exchange for a few hundred rand in premium. At the end of the day this would lead to Turnberry having to increase premiums, resulting in less people being able to afford Gap Cover.

If we now look at the same example but, in this instance, waiting periods do apply, Johnny would not be able to claim for the hip replacement within the first 12 months of the policy. Thereby protecting existing members from unsustainable premium increases and allowing more members access to Gap Cover.

I have had Gap Cover previously what waiting periods will apply to my policy?

If you have previously had a gap cover policy for more than 12 months on any like for like benefits the maximum that may be imposed is a 3-month general waiting period. For any new benefits that you did not have previously a 3-month general waiting period and up to 12-month condition specific waiting periods may apply.

If you have had a gap cover policy for less than 12 months then on any like for like benefits a 3-month general waiting period may apply and the balance of the 12-month condition specific waiting periods will apply. For any new benefits that you did not have previously a 3-month general waiting period and up to 12-month condition specific waiting periods may apply.

Why must I pay premiums when I cannot claim within the waiting periods?

This is a commonly asked question as most people look at the list of 12-month condition specific waiting periods that are imposed and say that nothing will be covered within the waiting periods. It is important to remember that there are thousands of medical conditions for example heart attacks, strokes, pneumonia and let’s not forget the ever-present Covid-19 that you can claim for outside of the 3-month general waiting period. Accidents are unfortunately a part of life and not something that one can control and we understand that therefore the 3-month general waiting period and 12-month waiting period for muscular-skeletal is waived in the event of an accident. An accident is defined as a bodily injury caused by violent external means.

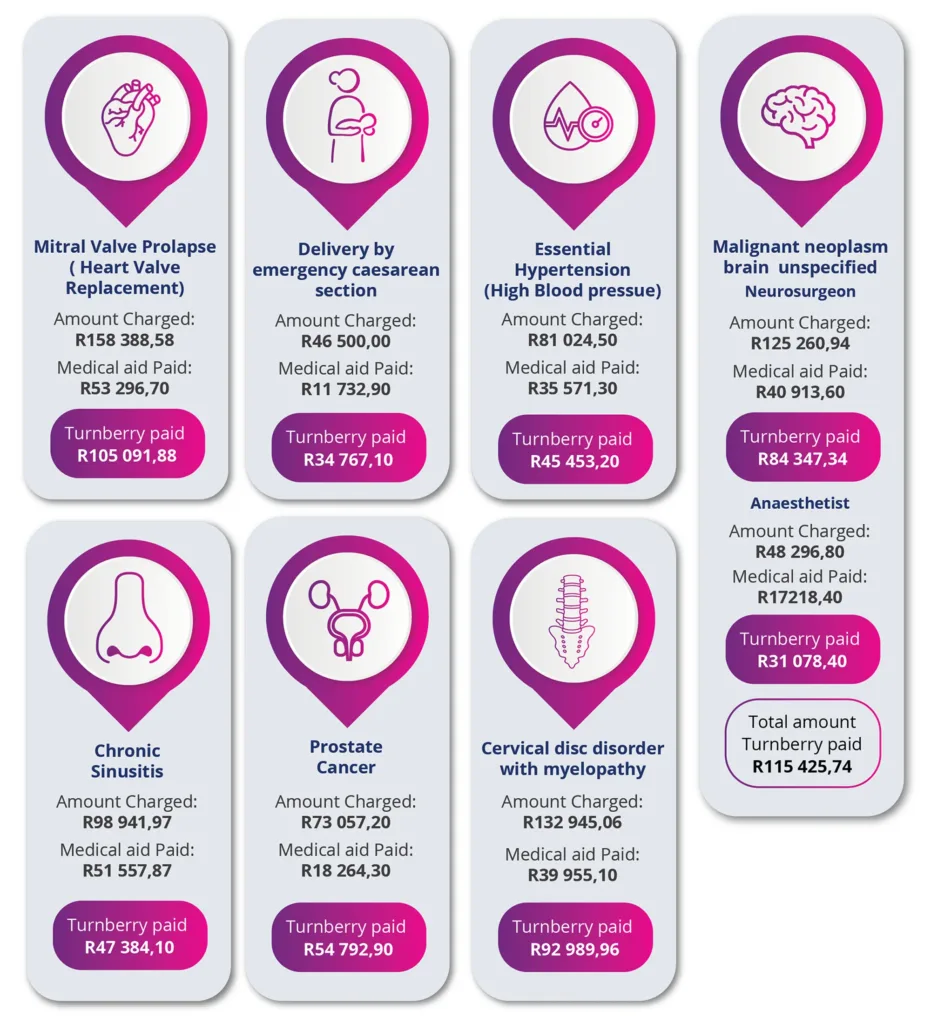

Claims paid by Turnberry over the past 12 months

Client Testimonials post claim submissions

Turnberry’s Gap Product settled my out of medical aid expenses. It is so important to have Gap Cover insurance, as you never know when you or your child will need this, and what really will be covered under your Medical Aid. I had a second co-payment implemented by my medical aid without any explanation and Wendy was brilliant in enquiring about this with the Medical Aid, and thereafter settling this. Dina Lala

Doctors charged above medical aid rates which required upfront co-payments. These co-payments were submitted to Turnberry for processing. My claim form was completed and submitted to my Broker on 29 June 2021. Payment of my 1st diagnosis of cancer was paid on 16 July 2021. On 9 July 2021, I received an email to advise that my claim was submitted to an assessor to conclude the assessment. Your timeous and prompt responses and feedback has assured me that Turnberry provides the best value for money which has benefitted me during my claim experience. I believe Turnberry provide a prompt, fast and efficient customer service and satisfaction. I would recommend Gap Cover which helps with the additional medical expenses. It covers the shortfall where Doctors and Hospitals charge above medical aid rate. The up-front co-payments for certain procedures and admission can be claimed from Gap Cover if you have the right benefit product in place. Excellent service. Highly recommended. Vijay Pillay

I was very impressed with the efficient and excellent service I received from Turnberry Gap cover especially Verna Nel. I was kept updated on the process of my claims and all queries were dealt with speedily. I have already recommended Turnberry Gap cover to friends and family as you will definitely have peace of mind when you are hospitalized and you are covered with Turnberry Gap cover. Thank you for your excellent service. Shanaaz

Turnberry paid the full difference between what medical aid covered and the cost of the procedure. It is a must have product with medical aid. Has much higher value compared to monthly amount paid. Thank you once again for quick and effective service. Some of rare exceptions of what really works well. Paulius

I was able to claim the added expenses after my knee surgery. I have had no problems with Turnberry and their service was helpful and efficient. Gap Cover Insurance is something that unfortunately in today’s times needs to be considered. A small expense to give one peace of mind. Turnberry claims division were quick and helpful in answering my questions. Dave

I wanted to write to you to thank you for your commitment to your customers. It was incredibly refreshing to receive the payment in good faith, as I can assure you, I would have NEVER received this kind of commitment from any other medical aid or GAP cover provider.

I will endeavour to give your company and your brand as much positive recommendation on social platforms that I can and felt it was crucial that I write to you to let you know that I will be a customer of Turnberry for life and I truly thank you for honouring your commitment to us. We appreciate your service and your service excellence. I am very proud to be a client of Turnberry. Thank you once again for your phenomenal service. Collette Roetz